Passing the Buck or Defeating Terror?

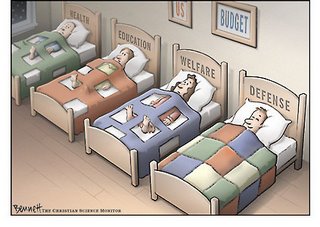

In a radio address to the nation, President Bush urged a major reduction in government spending on entitlement programs such as Social Security, Medicare, and Medicaid. President Bush threatened with the possibility of major tax increases for future generations and immediate cuts in benefits. All in all, Mr. Bush wants the federal government to spend 70 Billion dollars less on these programs in the next fiscal year.

The President also asked Congress to pass a Line-item veto, which would allow the President to veto certain provisions of a spending bill. The Supreme Court has ruled this unconstitutional during the Clinton administration (Governors are still given this right).

President Bush seems determined to balance the federal budget, just as he promised in his State of the Union address. Fiscal responsibility is a tenet of the Republican Party, and President Bush feels a great responsibility to curb massive government spending (even if it comes at the expense of social programs).

The budget that President Bush is proposing also included 245 billion dollars for the next two years for military operations in Iraq and Afghanistan. Add that to the 400 billion dollars that the wars have cost already.

If generation next is saddled with massive budget deficits, debt, and higher taxes, it won’t be because of entitlement programs. It will be because President Bush has made history by doing the unthinkable: fighting two wars and lowering taxes. The President has said repeatedly that he doesn’t spend time thinking about his legacy. If Iraq continues to cost hundreds of billions of dollars per year, entitlement programs may be sacrificed right when current high school students are looking in the mailbox for their Social Security checks.

4 Comments:

The War will be worth enormous costs. All wars are expensive. This one is no different

11:54 PM

Respect the President, you have got to be kidding me,

Yes, the war is expensive, but do the consequences truly have worth? The mere fact that an overwhelmingly large percentage of our tax dollars are being lodged into the tedious attempt to quell this insatiable war is frightening!

And what now of our social security benefits, our medicare? These are wonderful aspects of USA living that make our country so well-reknown.

But sorry, um, well, we need to clear up the untied ends of our bloody foreign escapade. Forget our country for a few years --- let's hopelessly try to bandage another!

So, we can forget about medical benefits for the poor, we can say goodbye to federal funds for stem cell research, we can apologize in advance to our children, to our childrens' children.

Thank you, President Bush.

9:47 PM

At this point in the game i feel it is useless to withdraw from the middle east and create a future of turmoil and destruction over there. Those effects may be far more devastating to the world than a US debt, which has now reached $8,698,187,001,424.41 and has increased furthermore in the time it has taken me to type it.

I think pres. bushy has talked himself into promises that he shouldn't be keeping, but if he did break them he would lose more popularity points (devistating!!!)

We are in a hole and have to learn to allocate our funds evenly if we want to have some sort of prospective future. America needs to learn self-control.

10:09 PM

Bush will be Bush and theres no changing that. Respect the president as your commander but you sure better question and criticize him. The truth is the debt is so enornmous that it isn't the old Hamilton vs Jefferson argument. So whether you believe in having a debt or balancing the debt it needs to be lowered somehow. I say lets examine the social security tax which ironically is a regressive tax. This however is debated because today the social security limit for the taxable amount is 94,200, so any money you make over that isn't taxable. Therefore those making less get a larger percent return when matched against what they paid originally than the rich would. However because the rich don't pay after the 94,200 the extra non-taxed moeny isn't taken into account, so lets simplify it and call it regressive.

What am I getting at? My point isn't that tax cutting is a bad thing. However, I believe at this point in time it is, when Bush threatens with the possibility of major tax increases for the future generations, that scares the poor. What I say happens is we have no limit on some programs like Social Security and have that taxed rate remain constant no matter what you make. Would it fix the problem? I don't know but it is a thought.

Another thought is possibly put some people in your cabinet with conflicting ideas to possibly get some new fresh ideas. A alas though in 2008 we will hopefully have something to vote on.

Stay the course in Iraq vs. Exit Plan.

Also hopefully...

Obama vs. McCain

ohh that would make me happy. :)

11:28 PM

Post a Comment

<< Home